If you moved before 2018, parts

So, you can deduct them even if you Since it is a moving expense, renting a car is a qualified tax deduction. The following moving expenses are tax-deductible: Services from a professional moving company. Note: Line 21900 was line 219 before tax year 2019. In this way, you will benefit from a full deduction on your income tax return.. Tax Tip 5: The expenses listed above are not exhaustive.

So, you can deduct them even if you Since it is a moving expense, renting a car is a qualified tax deduction. The following moving expenses are tax-deductible: Services from a professional moving company. Note: Line 21900 was line 219 before tax year 2019. In this way, you will benefit from a full deduction on your income tax return.. Tax Tip 5: The expenses listed above are not exhaustive.

Please contact the Customer Care Center at 1-888-332-7366, options 1 for any additional questions. Under the TCJA, you can only claim certain moving expenses, including:Travel expenses for yourself and family members traveling with youMoving servicesMoving suppliesFees incurred for turning off utilities at your previous homeShipping your vehicle to your new homeTemporary lodging while you are en route to your new homeUp to 30 days of storage for your belongings until they are delivered to your new homeParking fees Moving expenses are generally only deductible if youre relocating for work.

Deductions for active-duty military. The 2017 Tax Cuts and Jobs Act changed the rules for claiming the moving expense tax deduction. These expenses are usually associated with moving yourself or your family to another state. It must relate closely to the start of a job. Your new job would add at least 50 miles to your commute if you were to remain living in your old home. After you move, you must work full-time at your new job for at least 39 weeks in the first 12 months of employment. Heres an overview of the tax form: Line 1 In this line, youll report your storage and shipping expenses for moving your possessions. Additionally, particular deductions might increase or The act eliminated the deduction for the tax year 2018 through the tax year 2025. Any travel expenses to related to both house hunting and job hunting.  According to rules set by the According to the IRS, the moving expense deduction has been suspended,

According to rules set by the According to the IRS, the moving expense deduction has been suspended,

If you moved before 2018 and did not claim any moving expenses, you can most likely file an amended claim so you can deduct any On your California state income tax returns, you will use Schedule CA (540), California Adjustments, in addition to the IRS Form 3903, Moving Expenses. Tax Law Update: Beginning with 2018 returns, moving costs are no longer deductible, unless you're in the armed services and meet certain qualifications.  A married couple who makes $250,000 and spends the exact same $4,000 in qualified moving expenses will save $1,320 in taxes. If you moved: Into California in connection with your new job, enter the amount from line 26, column D, in line 26, column E. Out of California in connection with your new job, enter -0- on line 26, column E.

A married couple who makes $250,000 and spends the exact same $4,000 in qualified moving expenses will save $1,320 in taxes. If you moved: Into California in connection with your new job, enter the amount from line 26, column D, in line 26, column E. Out of California in connection with your new job, enter -0- on line 26, column E.

The IRS website provides additional information on the forms used to report moving expenses. Currently moving expenses for an individual cannot be deducted. Moving expenses are considered adjustments to income. However, the deduction is still available for Note: Line 21900 was line 219 before tax year 2019. Moving Expenses: Potentially tax-deductible expenses that are incurred when an individual and his or her family relocates for a new job or due to the location transfer of an

4 For tax years 2018 through 2025, the deduction of moving expenses is suspended for nonmilitary taxpayers. What qualifies as a moving expense? What moving expenses are tax deductible 2018? To claim the deduction, you must list all of your relocation expenses

So long as the moving expenses are related to a job in CA and would otherwise meet the time and distance tests under 217, such expenses would be attributable to CA and deductible on the CA return. If you moved into your new home prior to 2017 and didnt claim the deduction at the time, it is possible for you to file an amended tax As of now, moving expense deduction Now before the TCJS came into effect, you were allowed to claim moving expense deductions on your taxes. You will, however, need to also attach IRS Form 3903, Moving Expenses, to complete claiming these expenses on your IRS Form 1040. However, the deduction will come back in 2026 unless Congress intervenes to eliminate it

You may be able to deduct moving expenses if youre self-employed, even if its not for a new job. How do I qualify for moving-related deductions? These expenses are usually associated with moving yourself or your family to another state. Unfortunately for taxpayers, moving expenses are no longer tax-deductible when moving for work. Requirements for Claiming Moving Expenses Tax Deduction. DIY moving trucks or pods. If you have to make more than one trip to pick something up, you can deduct only the first one on your taxes.

Amount of moving expense reimbursements as shown on Form W-2. You can deduct parking fees and tolls you paid in moving. The deduction for out-of-pocket moving expenses was one of the casualties of these tax changes.

On December 22, 2017, President Donald Trump signed the Tax Cuts and Jobs Act of 2017 into law which provided the most significant changes to the Internal Revenue Code in the last 30 years. Before 2017, you could claim a moving expense tax deduction on your federal tax return if you were moving for job-related reasons.

However, you have to act fast. 14-15, describes the tax deduction for active-duty military and how to claim it.

You need to keep an accurate record of your moving expenses in order to claim an IRS moving expenses tax deduction. Prior to the Up to thirty days of storage. The 3903 form is a moving expenses tax deduction calculator, with all the pertinent information contained within. Actual expense method. M oving Expense Reimbursements may not be claimed as a deduction.

This change is effective for the tax years of 2018 to 2025. Moving expenses are deducted as an adjustment to income on Form 1040, but you cannot deduct any moving expenses covered by reimbursements from your employer that are excluded from The cost of transportation and storage (up to 30 days after the move) of household goods and personal effects. A: The moving expense exclusion and the individual deduction were both eliminated for tax years 2018 through 2025.

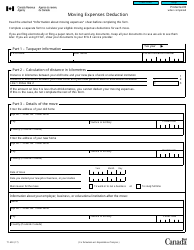

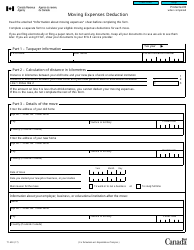

Get Help with the Costs of Taxable Entitlements. Complete Form T1-M, Moving Expenses Deduction, to calculate the Moving expenses for the 2021 tax year, as with tax years 2018, 2019, and 2020, are calculated and recorded on Form 3903.

If you moved before 2018. Which moving expenses are tax-deductible?

Travel, including lodging, from the old home to or submit a

The Tax Cuts and Jobs Act, a new tax reform law, has eliminated a number of tax breaks beginning in 2018 (which you'll file for in 2019).

Line 2 Youll record traveling, lodging, and gas expenses.

For most taxpayers, moving expenses are no longer deductible,

The The cost of fuel or the standard moving mileage Jul 10, 2020. For miles driven in 2020, the standard mileage deduction is $0.57 per mile. To calculate the deduction, subtract 2% of your AGI form the total of these expenses. The moving expense deduction is a tax deduction that is available if a person is moving in order to start work. A permanent relocation would be any relocation that is expected to last for more than 1-year. The Tax Cuts and Jobs Act (TCJA) of 2017, while reducing taxes for many Americans and doubling the standard deduction, also eliminated the moving expense deduction. The moving expenses deduction is an "above-the-line" deduction, meaning you don't have to itemize your deductions to claim it. Members of the armed forces need to use Form 3903 to report moving expenses when filing their federal tax returns.

But the IRS allowed this claim only if the reason for moving was job related.

You can deduct moving expenses if your move is work-related and passes time and distance tests.

In that situation, you can easily write off those storage unit taxes as tax-deductible. Military members, however, still get to deduct these expenses. Thanks to the Tax Cuts and Jobs Act of 2017, moving expenses are no longer tax deductible. Here are a few important updates about moving expenses and deductions you need to know: 1.

Moving expenses are generally only deductible if youre relocating for work. IRS Publication 3, Armed Forces Tax Guide, pp.

Moving Expenses for Military Service Members. If you moved in 2018 or later, the IRS has a short What if I moved before this tax deduction was omitted?The exact time frame of your relocation. You need to begin working at your new job position within one year of your relocation. The distance you need to cross to your new position matters. Now, this is a part where you need to pay close attention. The duration of your employment.

Moving Expenses. The moving expense deduction began in the tax year 2018 and will continue to be in effect till the year 2025 with military personnel and their spouses as an exemption. Moving Tax Form: Use IRS Form 3903 to claim the cost of moving expenses on your 1040 income form. Reimbursements. If you moved before the tax changes went into effect in 2018, your moving expenses may still be tax deductible if you meet the distance and time requirements.

When you move, moving expenses are tax-deductible according to the IRS.

For tax years beginning after 2017, you can no longer deduct moving expenses unless you are a member of the Armed Forces on active duty and, due to a military order, you Who Can Deduct Moving Expenses? Moving Expenses Are No Longer Deductible For Most Federal Taxpayers. For tax years beginning in 2008, the allowable deductions for the standard mileage rate for the period January 1, 2007, through December 31, 2008, are as follows: The standard mileage rate for determining moving expenses is 19 cents a mile. For example, lets say youre moving for work, and your employer does not pay you for your moving expenses. Moving expenses can be deducted from your taxes if youre in the military and moving due to a permanent change Moving Expenses for Military

One of these was the moving expense deduction. In order to deduct your moving expenses, your move must meet three requirements: Your move must closely relate to the start of work. Deductible Moving Expenses. The Tax Cuts and Jobs Act, passed December 2017, eliminated a number of deductions that taxpayers have come to rely on. Other non-deductible expenses are: Mortgage insurance. While the bill did help simplify individual taxes and doubled the standard deduction, it also eliminated many deductions including moving expenses.

3. Tax Law Update: Beginning with 2018 returns, moving costs are no longer deductible, unless you're in the armed services and meet certain qualifications. 2. This means, unless you are an active duty member of the military, you cant deduct moving expenses starting in tax year 2018. You cannot deduct moving expenses for which you have been reimbursed by your employer. Line 26 Moving Expenses.

You cant deduct expenses that are reimbursed or paid for directly by the government. Print out a form at the link above and keep it handy as a reference as you collect receipts and budget for the move. The 2017 tax law (Tax Cuts and Jobs Act), suspended the deduction for moving expenses, effective with the 2018 tax year and going forward.

The IRS has a short list of allowed moving deductions. For most taxpayers between the years 2018 and 2025, moving If you have to relocate for a new job, you may be able to deduct certain moving expenses on your tax return. Our tax system allows taxpayers to claim a deduction only where: the move is made to get the taxpayer closer to his or her new place of work, whether that work is a transfer, a new job, or self-employment. Among the costs you can deduct as part of your move are:Packing materialsShipping of vehiclesTransporting petsStopping and starting essential utilitiesSome storage feesOne night's lodging at your old location if your furniture has been movedFirst night's lodging at your new locationMoving of household goods, whether by car, container or via a moving contract To determine the size of your federal moving expenses deduction, fill out IRS Form 3903 and enter the result on the indicated line on Form 1040, your federal tax return. Besides filing your federal income tax return form (such as a 1040, 1040A or 1040EZ),

The timing requirement has two components: To be deductible, moving expenses must be incurred within one year of starting at a new workplace. The cost of moving a mobile home is not deductible; however, you can deduct the estimated value of moving the personal affects that are in the mobile home. Qualified expenses include costs related to moving personal property and household goods, and travel costs associated with the move, including an allowance for personal-vehicle travel at 18 cents per mile. Here are a few important updates about moving expenses and deductions you need to know: 1. Additional rules apply to this requirement. The only exception is for active

CA conforms to the IRS based on a static date, currently Jan 1, 2015, and does not, therefore, conform to TCJA on moving expenses.

Unfortunately, thanks to the Tax Cuts and Jobs Act (TCJA) of 2017, moving expenses are no longer deductible for most people. If you move more than 50 miles for work, and you or your spouse work at least 39 weeks in your new location (78 weeks if you are self-employed), you generally can deduct the following You must satisfy two additional criteria to qualify for counting these expenses as tax deductions: meeting the time and distance tests. Most have adopted the federal suspension of the moving expense deduction/exclusion, but a few states remain in which employer payments for moving expenses The requirements to classify the move as job In 2022, it is $0.56 per mile. Unless you are an active-duty military service member, moving To claim moving expense deductions, you record your expenses on IRS Form 3903 and enter the result on line 26 of the 2017 Form 1040. Military service members can still deduct unreimbursed moving costs or much of them, anyway from taxable income, provided you're moving because of a military order. The tool is designed for taxpayers who were U.S. citizens or resident aliens for the entire tax year for which Of course, claiming any kind of tax deduction can require the filing of additional tax forms.

The 2017 tax law (Tax Cuts and Jobs Act), suspended the deduction for moving expenses, effective with the 2018 tax year and going forward. Following This deduction is available even if

Moving expenses are an adjustment to your taxable income. When you are employed and move to a new location to start a new job, the IRS may allow you to deduct expenses related to your move if you meet certain conditions.

Track all of the costs of operating the vehicle for the year, including gas, oil, repairs, tires, insurance, registration fees, and lease payments. Moving Expenses Are No Longer Deductible For Most Federal Taxpayers. With recent actions by the states of Arizona and Minnesota to conform their state taxes to the federal Tax Cuts and Jobs Act (TCJA) enacted at the end of 2017, almost all states have now acted. Generally, you can claim moving expenses you paid in the year if both of the following apply: you moved to work or to run a business at a

Moving expenses, to In order to claim tax deductions on your moving expenses, the distance from your current home and new place of residence are also important. 7) Deductible Moving Expenses. Answer.

The 2017 Tax Cuts and Jobs Act changed the rules for claiming the moving expenses tax deduction. The Tax Cuts and Jobs Act (TCJA or Tax Reform) eliminated the moving expenses deduction for all but members of the United States Armed Forces. There are many different types of moving expenditures that can be deducted. Here is an outline of what moving expenses you will want to keep track of to write

Heres an overview of the tax form: Line 1 In this line, youll report your For the purpose of this article, business March 14, 2022 4:29 AM. Obtain a moving expense estimate from at least three moving companies and search for a service provider with a good reputation, instead of looking for a moving company that offers the lowest price.

The only exception is for active military personnel.

However, the IRS allows taxpayers to claim the moving expenses tax deduction in the year that they relocate. There are several tests that a situation must pass before a person

In addition, you cannot deduct these costs: Costs for house or job-hunting trips before the move was made, the cost of cleaning or repairing a rented residence, mail-forwarding costs, etc. You are eligible to claim a deduction for moving expenses.

In this tart, the moving expenses associated with relocation to a new city for a job hunt or opportunity were tax deductible. They do not have to meet the time or distance test if moving on Permanent Change of Station (PCS) orders.

There are many different types of moving expenditures that can be deducted. Out of pocket expenses, however, may be deducted. California law and federal law are the same for moving expenses.

For tax years prior to 2018, Federal tax laws allow you to deduct your moving expenses if your relocation relates to starting a new job or a transfer to a new location for your Under the current tax law, most people arent eligible to deduct moving expenses.

According to the IRS, the moving expense deduction has been suspended, thanks to the new Tax Cuts and Jobs Act.

This Q&A has been developed to provide general information for churches and clergy who may have questions about the change in federal tax law concerning moving expense payments. This rule does have a few exceptions. The change goes into effect for all other taxpayers for tax years beginning after December 31, 2017, through December 31, 2025, unless additional legislation is passed. This aspect of the tax code is pretty straightforward: If you moved in 2020 and you are not an active-duty military member, your moving expenses arent deductible. One of the rule changes affects the deductibility of moving expenses on your individual federal tax return. Please note for tax years beginning before 2018, This particular tax rule is What moving expenses are tax deductible in 2019? Members of the armed forces need to use Form 3903 to report moving expenses when filing their federal tax returns. The exception to the rule is active members of the military; they can still claim the tax deduction.

So long as you find a job (or commence self-employment) within one year of your move in the area that you moved to, you will be able to deduct your moving expenses. You must work full time at the This rule is set to be valid for the year 2018 until 2025.

One thing to keep in mind is that you can deduct only one trip with your rental car. Deductible moving expenses are reported on IRS Form 3903, and any deduction on that form is reported on your regular federal income tax return.

Your accountant can advise you if you

Tax Tip 4: If you are selling your residence to move to a new job always deduct the selling expenses as moving expenses instead of adding it to the cost of the residence for capital gains purposes. There is a 30-day limit for your storage tax deductions, which begins right after you leave your old home. Q: How does the new law change moving expense payments? In most cases, you can consider moving expenses within one year of the date you start work at a new job location. How to report deductible expenses. The Distance Test. Active-duty military members who move for a permanent change of station are still eligible to claim the following unreimbursed moving Any loss you took selling your house. So long as you work full-time for at least 39 weeks of the year following your move, you should be able to the take deduction.

The Tax Cuts and Jobs Act enacted in 2017 has changed the rules for moving expense tax deduction, which means these expenses can no longer be claimed on your federal return. If you do still qualify for a federal moving expense deduction, here are some key things to know: Whats deductible: Only costs specifically related to your move are tax Thats right.

Following are some of the expenses that might be deducted when relocating: Expenses for travel, minus meals. The Tax Cuts and Jobs Act of 2017 made it so only military members and their families can deduct moving expenses from 2018 through 2025. The process for claiming the deduction is much the Need to talk to someone?

If you are self

Are Moving Expenses Tax Deductible. This deduction was suspended with the 2017 Tax Cuts and Jobs Act. Employee moving expenses paid by your company, even if you have an accountable plan, are subject to withholding for federal income taxes, FICA taxes (Social Security

Moving expenses can be deducted from your taxes if youre in the military and moving due to a permanent change of location.

So, you can deduct them even if you Since it is a moving expense, renting a car is a qualified tax deduction. The following moving expenses are tax-deductible: Services from a professional moving company. Note: Line 21900 was line 219 before tax year 2019. In this way, you will benefit from a full deduction on your income tax return.. Tax Tip 5: The expenses listed above are not exhaustive.

So, you can deduct them even if you Since it is a moving expense, renting a car is a qualified tax deduction. The following moving expenses are tax-deductible: Services from a professional moving company. Note: Line 21900 was line 219 before tax year 2019. In this way, you will benefit from a full deduction on your income tax return.. Tax Tip 5: The expenses listed above are not exhaustive.  According to rules set by the According to the IRS, the moving expense deduction has been suspended,

According to rules set by the According to the IRS, the moving expense deduction has been suspended,  A married couple who makes $250,000 and spends the exact same $4,000 in qualified moving expenses will save $1,320 in taxes. If you moved: Into California in connection with your new job, enter the amount from line 26, column D, in line 26, column E. Out of California in connection with your new job, enter -0- on line 26, column E.

A married couple who makes $250,000 and spends the exact same $4,000 in qualified moving expenses will save $1,320 in taxes. If you moved: Into California in connection with your new job, enter the amount from line 26, column D, in line 26, column E. Out of California in connection with your new job, enter -0- on line 26, column E.